It's time for Domino's Pizza Enterprises (DMP) to report their FY21 half year results, so we decided to take another little look at their business. Here is some of what we found.

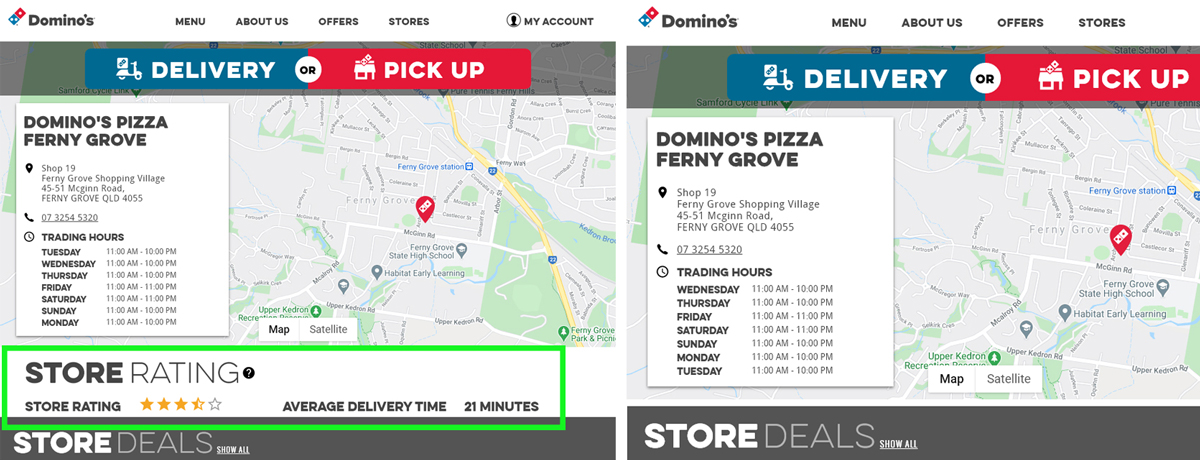

Our last DMP research article revealed their 2016 initiative Project 3TEN (pizzas ready for pickup in three minutes and delivered within 10 minutes) was appearing to fall well short. Since then, for reasons unknown to us, each store website no longer shows Average Delivery Times (ADT). With no more transparency around ADT, the ability to analyse their numbers has been removed.

As at 19 January 2021, 488 (69%) out of 707 Australian stores had an ADT of greater than 20 minutes or more when reviewing each store's page on Dominos.com.au. To use Domino's own words when referring to ADT: "Customer satisfaction...significantly decreases after 20 minutes". Read more.

Litigation

In recent years (December 2018 & 2019), Domino's Pizza has been the subject of two Federal Court filings. In both cases the claims were filed by long term award-winning franchisees who operated more than one store. Both claims alleged misleading and deceptive conduct. It is our understanding that both settled quickly and out of court.

The Northern Beaches Trust and Hot Cell Pty Ltd Partnership

Note: We have chosen to refer to franchisees as Franchisee A, B & C, rather than by name. It is assumed Franchisees B and C were under the same Franchise Agreement.

On 4 April 2016, DMP acquired 50% of the equity in a joint venture called Northern Beaches Enterprises Pty Ltd (NBE) as trustee for the Northern Beaches Trust / Hot Cell Pty Ltd Partnership. Franchisee A is the sole director of NBE.

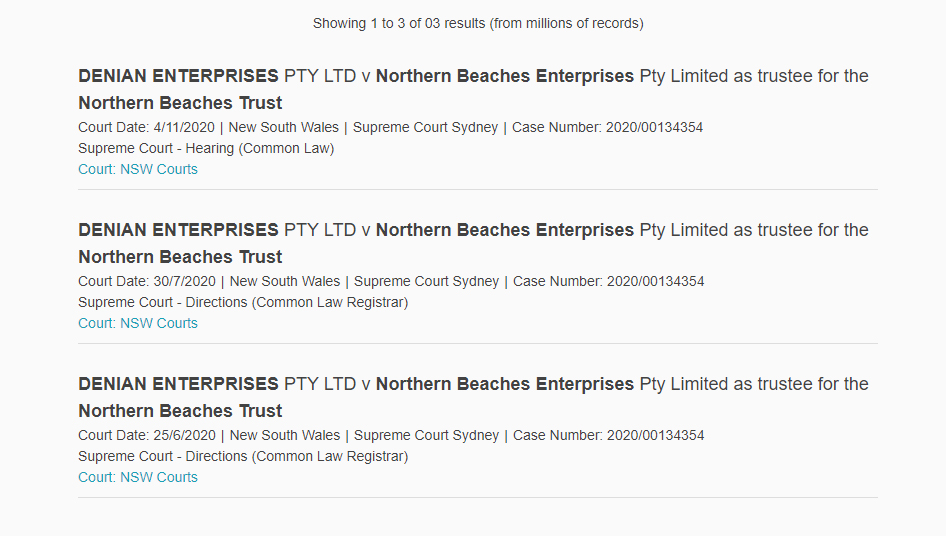

On 4 June 2020, our software alerted us to a NSW Supreme Court matter that involves the Northern Beaches Trust, titled: Denian Enterprises Pty Ltd v Northern Beaches Enterprises Pty Limited as trustee for the Northern Beaches Trust.

According to a publicly available copy of a November 2020 Sub-Franchisee Disclosure Document, the parties to the matter were:

Plaintiffs - Denian Enterprises Pty Ltd, [Franchisee B], and [Franchisee C].

Defendants - Northern Beaches Enterprises Pty Ltd as trustee for the Northern Beaches Trust, Hot Cell Pty Ltd, [Franchisee A], and Domino's Pizza Enterprises Limited.

The Disclosure Document reveals some details about the litigation.

“The Doyle Proceeding concerns a store located in Manly, NSW formerly operated by the Plaintiffs. The plaintiffs allege, among other things, that there were a number of misrepresentations made to them concerning staff, profitability and sales information prior to entering into the sub-franchise agreement. As against the Master Franchisee, the claim alleges negligence and/or wrongful termination of contract. As against other defendants, the plaintiffs allege misleading and deceptive conduct and/or misrepresentation, breach of contract and breach of duty. The Master Franchisee rejects the allegations and is vigorously defending the Doyle Proceeding.”

Keeping in mind this litigation and some of the parties involved, let's examine the operator history of the Narrabeen store.

Domino's Pizza Narrabeen Store (No.98324)

Operator 1 - Wind Up (2012)

Note: We don't know if there were operators prior to this.

According to ABN Lookup, Sonimod Pty Ltd (Dominos spelled backwards) had the trading name ‘Dominos Pizza Narrabeen' from March 2003. Franchisee A was the sole director.

In late 2008, Receiver Managers were appointed, followed by Administrators in early 2009. Later in 2009, Appointed Liquidators came in. By early 2012, the Liquidator filed the Final Accounts Of Creditors' Voluntary Winding Up with ASIC, with many thousands owed to unsecured creditors. Sonimod Pty Ltd was deregistered in July of 2012.

Operator 2

We are led to believe the NBE entity (Director: Franchisee A) operated the store in this period and sold to Fabmark Australia Pty Ltd in mid 2014.

Operator 3

On LinkedIn, the sole director of Fabmark Australia Pty Ltd (deregistered in 2018) lists himself as the franchisee for Domino's Narrabeen from January 2014 - May 2017.

According to online records it appears the store was moved just over 100 metres on the same street in mid 2016, from 5/19 to 1/63 Waterloo Street in a position of similar prominence. It maintained the same store number of 98324. We don't know why the store moved.

Operator 4 - Liquidation (2020)

Got Pizza Pty Ltd (trading as Dominos Mona Vale & Narrabeen) was registered in March 2015. It is unclear when Got Pizza Pty Ltd operated the Narrabeen store. It is likely this entity operated the store after May 2017. Franchisee A was one of the founding directors, and NBE was a shareholder. Franchisee A ceased being a director and, we assume, NBE ceased being a shareholder in February of 2017.

A liquidator was appointed in February of 2020 and Got Pizza Pty Ltd ceased trading. In a statutory report by a liquidator to creditors, it says the stores had been taken over by the head franchisor.

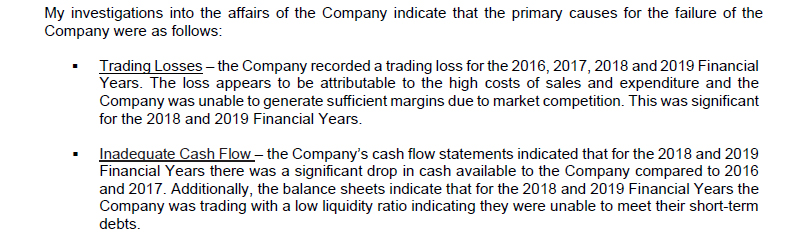

The report also says “The Directors has (sic) advised that the Company failed due to insufficient cash flow as a result of Dominos Pizza's poor strategic business and profit models”. The report goes on to list the primary causes for the failure of the company.

The report also said “I have identified a total insolvent trading claim of $150,084.86. I am considering if it will be commercial and beneficial to creditors to pursue the current director for insolvent trading”.

The report says around $500,000 is owed to unsecured creditors, among other monies. “I am aware of thirty (30) unsecured creditor (sic) with a claim totalling $504,494.86. The amount of $103,439.73 being outstanding debt to the Australian Taxation Office. I note that this amount does not include any amounts owing to ANZ, as detailed above, as ANZ have not lodged any claims in the Liquidation”.

Operator 5

The Got Pizza Pty Ltd liquidator report indicated that Domino's head office took over the Narrabeen and Mona Vale stores. This would have happened on or around February 2020. We don't know if Domino's paid any money for the stores or if NBE was involved.

Operator 6

In late February 2020, a company named Virtual Direct Pty Ltd registered two business names, Domino's Pizza Narrabeen and Domino's Pizza Mona Vale. As far as we are aware, this company currently operates the two stores. We don't know how much was paid for the stores, if any, or to what entity.

The history of the Narrabeen store and other stores that we have heard of raises the question of churn. Is this an example of churn or perhaps an example of Domino's acting responsibly to find the right franchisee for the right store?

It is important to remember that the Domino's store resale process involves DMP approving new franchisees. Franchisors often justify churn-like behaviour by arguing “the last franchisee ran the store poorly”. In the case of the Narrabeen store, it may be hard to make that argument, given that Franchisee A appears more than once through the store's history.

A big question on our minds when researching this company, and after talking to various franchisees, concerns the quantum of unpaid taxes to the Australian Tax Office (ATO). A common theme with struggling franchisees in general is to put off paying taxes so they can afford to survive. It is a problem that can remain largely hidden, but franchisors should hold that information.

What percentage of Australian franchisees have unpaid tax debts with the ATO, and what is the average amount owing? We think this is an important question that could be asked of the company.

Notice

- We are not suggesting that Domino's Pizza Enterprises Limited, Northern Beaches Enterprises Pty Ltd, other related entities and their directors have done any wrong.

- We do not invest in any stocks (with the exception of our Superannuation funds) and have not been incentivised or paid to produce this research.

- This is not investment advice.

Sources

- https://static1.squarespace.com/static/5bd052c7c46f6d0e23b11afb/t/5bdfbeff0ebbe857b72ffbec/1541390158124/1850024.pdf

- https://abr.business.gov.au/ABN/View?abn=19095969510

- https://web.archive.org/web/20160327172302/https://www.dominos.com.au/store/nsw-narrabeen-98324

- https://web.archive.org/web/20160619195113/https://www.dominos.com.au/store/nsw-narrabeen-98324

- https://publishednotices.asic.gov.au/browsesearch-notices/notice-details/GOT-PIZZA-PTY-LTD-605059185/f32b8aa3-1693-4c7a-a25f-dd0a8191ed99

- https://abr.business.gov.au/ABN/View?abn=36159620158

Published: 16 February 2021

Disclaimer: This was compiled and prepared by Diligence Research Pty Ltd (Diligence Research). The information was collected using qualitative data collection techniques, with all research sources believed to be reliable. No representations or warranties (expressed or implied) are made by Diligence Research or their representatives, to its accuracy, completeness or correctness. Views, ideas, opinions and estimates contained within, stand as Diligence Researchs judgment as of the date of this post. Nothing in this constitutes legal, financial or investment advice, and it has been prepared without regard to individual financial circumstances or objectives of those who receive it. Diligence Research does not accept liability whatsoever for any direct or consequential loss arising from any use of this information.